Life growing up

I was born and raised in Finchley, North London – the eldest of four kids in a noisy, busy household.

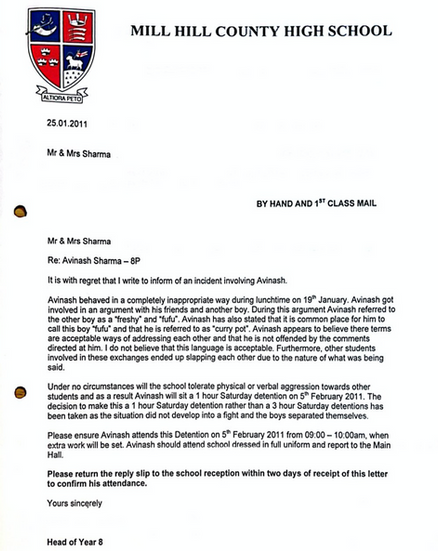

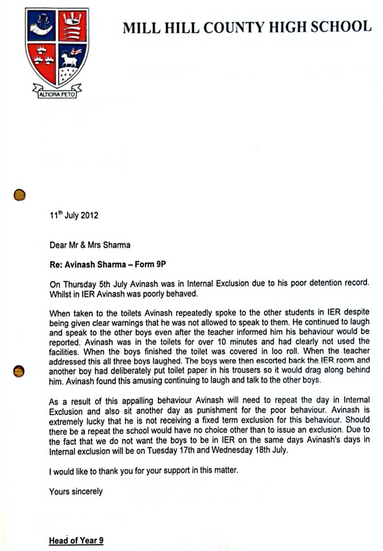

At age 11, I launched my first business, selling unwanted junk from my bedroom to my brothers: bouncy balls, trading cards, and Nintendo DS games. With my second business at age 12, I stepped it up a notch, selling sweets on the playground, which was strictly against the policy of the selective grammar school Mill Hill County. It was a top button done up, shirt tucked in type of school. Not quite the place for a risk-taking entrepreneur.

A product of my parents' rigorous upbringing, I started at Mill Hill as a rule-abiding citizen, but this didn't last long. By the time I was 13, I was challenging teachers and acting ridiculous for laughs. My sweet-selling business was the natural extension of my rebellion. I would buy seven packs of Chewits for £1 from Poundland and resell a single pack for the same price. At the peak of my little business venture, I was making over £100 each week in profit. But before I knew it, the playground confectionary market became saturated. I needed to pivot.

My family's Costco Wholesale membership was the key to my new success. One day, I found myself strolling the aisles with my Mum and siblings, and having left my wallet at home, I turned to my two unlikely heroes: my little brothers. They lent me money, and I promised to return their investment with added interest. I loaded my schoolbag with Skittles. No student had ever sold Skittles at school before; my product was selling fast. I brought 30 packs per day, making my schoolbag extremely heavy. I had to be vigilant: teachers were emptying hefty-looking rucksacks, confiscating stock, and dishing out Saturday detentions to sellers (fortunately, I never got caught!)

My teenage years

Eventually, my Costco Skittles business had to end – teachers were becoming wary of the playground market. I needed to think outside the box for my next endeavour. My third business came at 14, selling Peter Gribby polo shirts from Brent Cross Shopping Centre. By buying them in bulk, I bargained the price down to around £15 a pop, funding my purchases with profits from my sweet sales. I streamlined my distribution channels by advertising them on Facebook. My plan was foolproof – if I couldn't sell any, I'd return them within 28 days for a full refund. There was nothing to lose.

I'll never forget when I sold Remus Yeung two polo shirts, quietly undertaking our transaction in the French block toilets. He paid me with a single, crisp fifty-pound note. Wow. I had never held a fifty before in my life. Selling clothes was more lucrative than sweets. No more lugging my bag across the playground. I laughed at the schmucks in my year who sold sweets and got caught by teachers.

As I approached Year 10, I wore different designer jackets to school each day: Lyle and Scott, Fred Perry, and Topman. I also owned many cheap watches with gigantic bezels. Five watches and five jackets per week. I felt like the Wolf of Wall Street. I always smelled good too; my go-to cologne was 1 Million by Paco Rabanne. Suddenly, I was getting noticed by the ladies. I started getting into bigger trouble with teachers at school. I was never a bad kid, just an attention-seeker (see below).

At 15, I launched my fourth business with FIFA 13 Ultimate Team, focusing on "quick selling." This involved selling players to the system for coins. I discovered a market arbitrage – certain players could be "quick sold" for a higher price than purchased, guaranteeing me a profit of 200-500 coins per player. I soon had over 1 million coins, selling 10,000 for £10 to students all over North London. I found clients at the bus stop. It amazed me how virtual items could be sold for real money.

I retired from my FIFA enterprise at age 16 as GCSEs began to loom. I resented studying and ended up massively underperforming. So as my A-Levels dawned, I realised this was time to pull my socks up, and for two years, I worked relentlessly. I said NO to all distractions – business, driving, girls and clubbing. On results day, aged 18, I got A*AA, landing me a place to read Economics at the University of Nottingham. On the bus home, I played Champion by Kanye West. I felt on top of the world.

University

Uni was a complete blur. I went clubbing three times a week, and it was here that I found the inspiration for my fifth venture: selling club tickets. CRISIS was the biggest night at Nottingham University, and tickets sold out on their website in under 30 seconds. I leveraged my network to find a Computer Science student who built a programme, enabling us to buy thousands of CRISIS tickets at once. Aged 20, I spent my entire student loan on tickets, buying them for £6 each and, due to insane demand, re-selling for them for up to £40.

I found myself living and breathing my ticket business, neglecting my Economics exams, and focusing on sales. In the end, I scraped the 2.1, but more importantly, learnt that I could successfully juggle business and life, giving me the confidence to dream bigger.

Avi TV

Just a month after graduating, I found myself working for Barclays in Canary Wharf. I was on the Graduate Scheme, working long and gruelling hours, developing a work ethic I had never seen in myself before. Riding on the high of my new successes, I started Avi TV. I went public on all platforms, launching my personal brand centred around business, wealth, and success.

Launching Avi TV wasn't a decision I took lightly, but I needed to share the value I had to offer with others. My key aim was to give more, deriving from give more, expect less. In life, we should expect nothing; hence, my motto is give more.

The Apprentice

In early 2022, I got promoted to Assistant Vice-President at Barclays: a bittersweet moment, as I was doing a job I despised. I negotiated my salary – it was silly money for a 24-year-old, so I stayed. But secretly, I was plotting my escape. My dream was to pursue Avi TV full-time.

One day, thinking nothing of it, I applied to Series 17 of BBC's The Apprentice. Somehow, I flew through the interview stages, and before I knew it, I received a call from the Executive Producer saying they wanted me on the show. When I told Barclays about my offer, they gave me the biggest dilemma: The Apprentice or my banking job. A well-paying job I had worked bloody hard to get, or a dive into the unknown (a sabbatical was impossible because I was new to the role). It took me a whole ten seconds to make my decision. I thanked them for the opportunity and quit in style that very day, never to be seen again.

I accepted the Barclays job offer, aged 21, for extrinsic reasons: to please my parents, improve my status, and earn money. Over the three years, I learned that money was futile if I wasn't learning important skills. I shifted my perspective, realising that real risk-takers stayed in jobs that didn't serve them and compromised their long-term happiness.

It was always a dream of mine to break free from my 9-5 and take Avi TV full-time. My heart was in business. I was NOT put on this planet just to climb the corporate ladder. The Apprentice gave me a chance to take a gamble and do what I truly love.

Fast forward to today. It's strange to be officially unemployed. I found myself as a candidate on one of the most famous TV shows in British history. It was difficult to put into words how grateful I felt for this opportunity. Sometimes I ask myself, "why me?" But then, I remind myself that it was meant to be. Let's do this!